Inflation is often referred to as the “silent killer” of purchasing power, and its effects can be more significant than they initially appear. Understanding how inflation works and how quickly it erodes wealth is crucial for anyone looking to preserve their financial stability. One simple yet powerful way to understand inflation’s impact on your money is through the *Rule of 72*, which can help calculate how long it will take for inflation to halve the value of your money. This article will break down how inflation affects savings, explain the Rule of 72 in detail, and offer practical strategies for combating inflation in your finances.

Understanding the Basics of Inflation

Inflation is the rate at which the general price level of goods and services rises, leading to a decrease in purchasing power. When inflation is positive, the cost of everyday essentials, from food and housing to transportation and utilities, gradually increases. Consequently, the same amount of money buys fewer goods and services over time, which can significantly impact anyone who keeps their cash idle in a low-interest bank account.

In countries like Malaysia, inflation has generally been kept low, averaging around 2% over the past decade. However, even modest inflation can substantially affect purchasing power over extended periods. For people in income groups such as the B40 and M40, who spend most of their income on essentials, inflation’s effects can feel especially severe.

The Rule of 72: A Simple Calculation for Inflation’s Impact

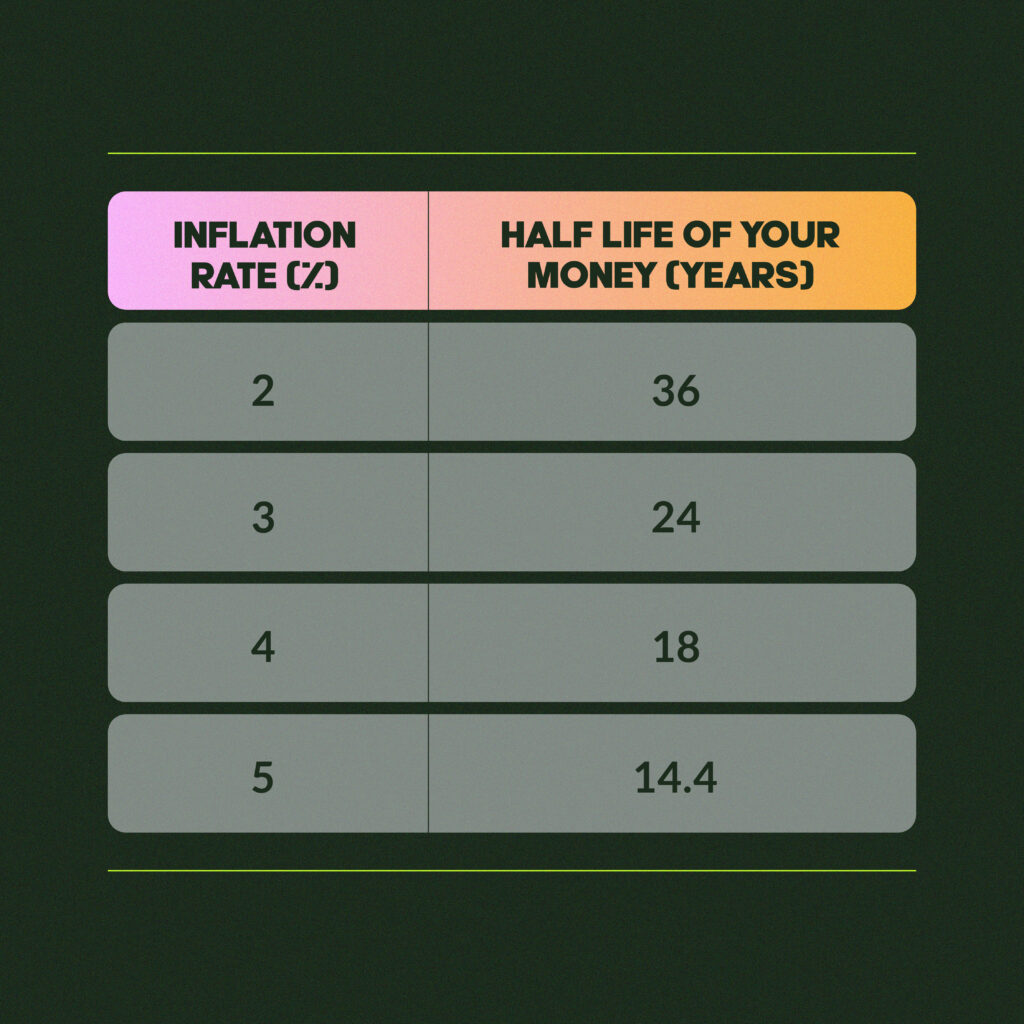

The *Rule of 72* is a quick formula that helps to calculate the time it will take for inflation to halve the value of your money. To use it, you simply divide 72 by the annual inflation rate. The result is the approximate number of years it will take for money to lose half of its value under current inflation conditions.

The speed at which inflation erodes wealth increases dramatically as the rate rises. While 2% may sound minor, it will still reduce the value of money significantly over a few decades. At a higher rate, the effects are compounded faster, highlighting the need for strategic financial planning to safeguard savings.

Why Some People Feel Inflation More Intensely

In Malaysia, the official inflation rate, calculated by the Department of Statistics, often shows a modest figure, averaging around 1.99% over the past decade. However, inflation is often experienced differently depending on income level and spending habits. For lower-income groups like the B40 and M40, much of their income goes toward basic necessities, such as food, rent, and utilities—categories that tend to rise faster than general inflation.

This “felt inflation” can create the perception that prices are increasing faster than the official rate, especially as people experience price hikes on essentials that make up a larger portion of their budgets. This disparity often leads to a higher perceived inflation rate, making it feel as though purchasing power is eroding more rapidly.

Understanding “Lower Inflation” and Misconceptions About Price Drops

A common misconception arises when people see news that inflation has slowed, for instance, from 2% to 1.9%. Many may interpret this as prices falling, when in fact, a lower inflation rate simply means prices are increasing at a slower rate than before. Prices continue to climb as long as inflation is positive; the increase just happens more slowly.

This misunderstanding is important to address because it can lead to complacency in financial planning. Even with a low inflation rate, the value of cash sitting in a traditional bank account still decreases over time. Recognizing this fact is key to understanding the need for proactive financial strategies to protect against inflation’s erosion of wealth.

Practical Strategies to Combat Inflation

Fortunately, there are ways to minimize the impact of inflation on your savings. Here are some effective strategies:

1. Avoid Leaving Money Dormant in Bank Accounts

While traditional bank accounts offer security, they usually provide very low interest rates, often below the inflation rate. Keeping large amounts of cash in such accounts virtually guarantees a loss of purchasing power over time. Instead, consider moving a portion of your savings into higher-yield options.

2. Leverage Digital Banks and Cash Apps

Many digital banks and cash apps offer competitive interest rates that can be significantly higher than traditional banks. Additionally, these platforms often come with low minimum deposits and flexible withdrawal terms, making them accessible and practical for most people. Some even allow users to start saving with as little as RM1, which lowers the barrier to entry and enables gradual savings growth.

3. Consider Investments that Outpace Inflation

Investing in assets that historically outperform inflation, such as stocks, real estate, or bonds, can be an effective way to preserve and grow wealth. While these options come with varying levels of risk, they generally offer returns that can exceed inflation over the long term. For example, certain equity-based investments, mutual funds, or exchange-traded funds (ETFs) provide diversified exposure to the market and can help shield savings from inflation’s impact.

4. Use Inflation-Protected Financial Products

Some financial products are specifically designed to guard against inflation. Treasury Inflation-Protected Securities (TIPS), for example, are government bonds that adjust their interest payouts in line with inflation. While not widely available in all markets, similar instruments can offer a reliable way to safeguard a portion of your portfolio.

5. Plan for Long-Term Goals with Inflation in Mind

When setting financial goals, especially those that span multiple decades, factor in the expected rate of inflation. For instance, if you’re saving for retirement, aim to accumulate enough so that your nest egg can support a lifestyle that considers inflation over the years. A common approach is to assume an average inflation rate of 2–3% and calculate accordingly.

The Importance of Actively Managing Finances in an Inflationary Environment

The average person may not feel the effects of inflation on a daily basis, especially when the official rate is low. However, the gradual erosion of purchasing power accumulates over time and can lead to significant financial setbacks if not managed properly. By actively planning and investing, you can help offset the negative impact of inflation and ensure that your money retains its value and purchasing power.

For many people, particularly in lower-income brackets, inflation is a harsh reality that limits financial freedom and increases economic vulnerability. Being proactive and adopting financial strategies that counter inflation is essential to protecting wealth and achieving long-term financial stability.

Conclusion: The Value of a Proactive Approach

Inflation is a persistent force that quietly erodes savings, especially for those who rely on traditional bank accounts. By understanding the Rule of 72 and taking steps to keep savings growing at or above the rate of inflation, individuals can better protect their purchasing power and financial security. In today’s digital age, tools like high-yield digital banking, low-cost investment apps, and inflation-protected financial products make it easier than ever to counter inflation effectively.

Ultimately, taking a proactive approach to managing money, investing in diversified assets, and leveraging modern financial tools can go a long way in securing financial stability and preserving wealth for years to come.

*This is not financial advice. Please do your own research (DYOR) before making any financial decisions.