FITERs are made up from teams of professional traders. You have heard that many times, now let’s get into the details. To be eligible as a FITER, the trader needs to be able to prove the following:

- Have related educational background in Finance

- Have at least 5 years of trading experience with proven track performance

- Have solid startup foundation of at least 5 million USD

Every FITER has a dedicated profile page, showcasing the following information aimed to let you make better informed decisions.

Total Rewards Generated

This is a graph showing the total rewards distributed, in USDT by the FITER since its inception.

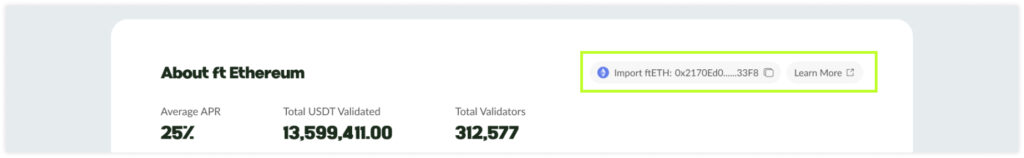

About

This section gives an introduction of the FITER along with essential statistics like Average APR, Total Validated Amount (total amount of deposits) and Total Validators (total amount of users who deposit).

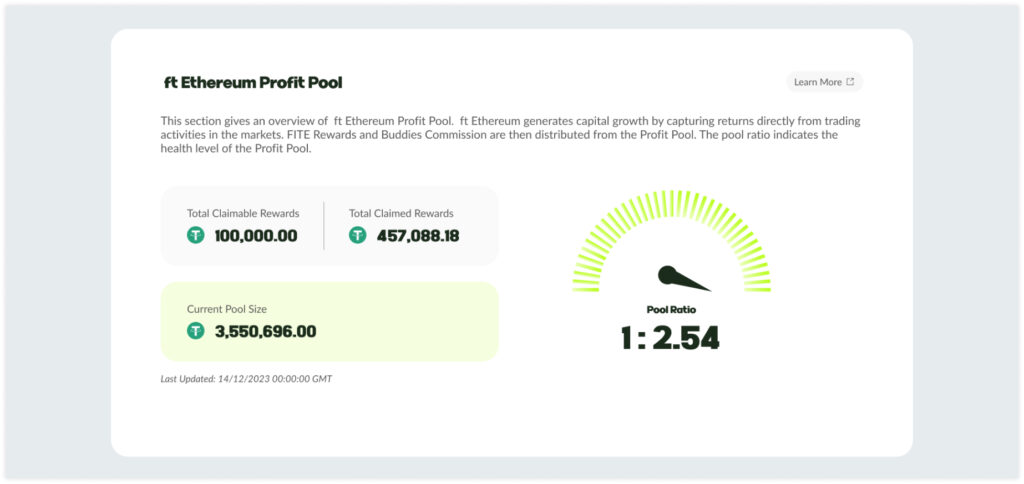

Profit Pool

Profit Pool is important in the FITE ecosystem. This is where the profits go to and rewards come out from. This section gives a transparent look into the FITER Profit Pool. The Current Pool Size fluctuates based on the following factors:

- Trading Profit: When FITER closes an order from the markets, the profits will go into the Profit Pool, increasing the amount of the pool.

- Claiming of FITE Rewards and Buddies Commission: When a claim is made, the rewards will be distributed from the Profit Pool, reducing the amount of the pool.

The ratio helps highlight the current health of the Profit Pool where:

1 : >= 2 – For example 1 : 3. The pool is in excellent health, in which the current pool size is at least double of the total rewards to be claimed. This may be due to FITER constantly earning higher profit rates than the APR distributed.

1 : >= 1 – For example 1 : 1.5. The pool is in very good health, in which the current pool size is larger than the total rewards to be claimed. This may be due to FITER constantly earning higher profit rates than the APR distributed.

1 : < 1 – For example 1 : 0.9. The pool is in average health, in which the current pool size is slightly lower than the total rewards to be claimed. This may be due to challenging market conditions or other unforeseen circumstances.

Through proven mechanisms and risk management, FITERs strive to maintain the good health of the Profit Pool by making sure that the pool size is higher than the Total Claimable Rewards daily. This can be achieved through consistent return and adjusting of rewards APR.

Order Summary

This section shows the order summary of trades closed by the FITERs. You may see all orders and Profit/Loss in detail. Note that floating orders are not shown in this section.

Annual Percentage Rate

FITERs strive to offer higher APR than traditional liquid staking, but high APR is not guaranteed. Overall, the APR averages around 100% – 120%. APR fluctuates based on various reasons, including but not limited to:

- Trading Performances

- Market Conditions

- Total Validated Amount

- Total Validators

FITERs can have different strategies in trading as well as in setting the APR. Full considerations are often put in place in order to balance between the attractiveness and the growth of a healthy Profit Pool.

Contract Address

FITERs run independently and manage separate Fund Pools. Once validated, you will receive FITERs liquid tokens in which you may check out the contract addresses below.

ft Ethereum

Token contract address: 0x8282F779A57Cdb190799b823cc44126Ea25BC032

Token symbol: ftETH

Token decimal: 4